As a beneficiary of Horizon Europe funding, it is crucial to follow Horizon Europe financial guidelines and understand how to create a financial statement within the Participant Portal. This article provides a step-by-step guide on creating a financial statement and covers various cost categories eligible in Horizon Europe projects. By following these steps, you can ensure compliance with the European Commission's requirements and submit an accurate financial report.

At the end of each reporting period, it is required to prepare an interim or periodic report, consisting of a technical report and a financial report (financial statement) that accounts for eligible costs. The financial report must be submitted by each beneficiary online through the European Commission's Funding and Tender Opportunities Portal.

For every reporting period, a single financial statement is required. Starting from the second reporting period, adjustments can be made to the previous period's statement. These adjustments may be necessary if all costs were not declared, or if too many costs were declared, thereby affecting the requested contributions for the current periodic report.

It is imperative to meet the deadline, which is typically within 60 days after the end of each reporting period. During this time, the coordinator must submit the complete interim or final report to the EU Commission or funding agency. Failure to meet this deadline could result in penalties, including the possibility of having your grant funding reduced or cancelled.

In case a beneficiary fails to meet the deadline, the relevant financial statement may be included in the financial report for the subsequent reporting period. Extensions are only possible for the last reporting period, and it is crucial to adhere to the specified timelines to ensure compliance with the reporting requirements.

Creating a financial statement in Horizon Europe within the Participant Portal

Prepare the financial statement

This task, while time-consuming, is by far of utmost importance. The preparation of the financial statement requires the collection and organisation of all financial data related to your project participation, in accordance with Horizon Europe guidelines. The financial information must be clear, concise, and accurately reflect all eligible costs incurred throughout the project. However, this is only one aspect of the task. The cost and time expenditure over the reporting period must align accurately with the project's progress, with no overspending or deviations from the plan. Personnel costs and person-months spent should be balanced, reflecting justifiable personnel cost rates. This can only be achieved by maintaining a real-time financial overview, enabling the coordinator to react promptly if necessary. By utilising financial management software such as EMDESK, your financial data should already be well-organised and readily accessible.

Accessing the Participant Portal

Log in to the European Commission Portal using your personal EU login credentials. If you do not have an account, you will need to create one. The Funding & Tenders Portal is the online platform used by the European Commission for managing Horizon Europe grants.

Navigate to your project

Once you are logged in, you will need to navigate to your project. This is typically done by selecting the relevant call for proposals and then selecting your project from the list of grants.

Complete and submit the financial statement

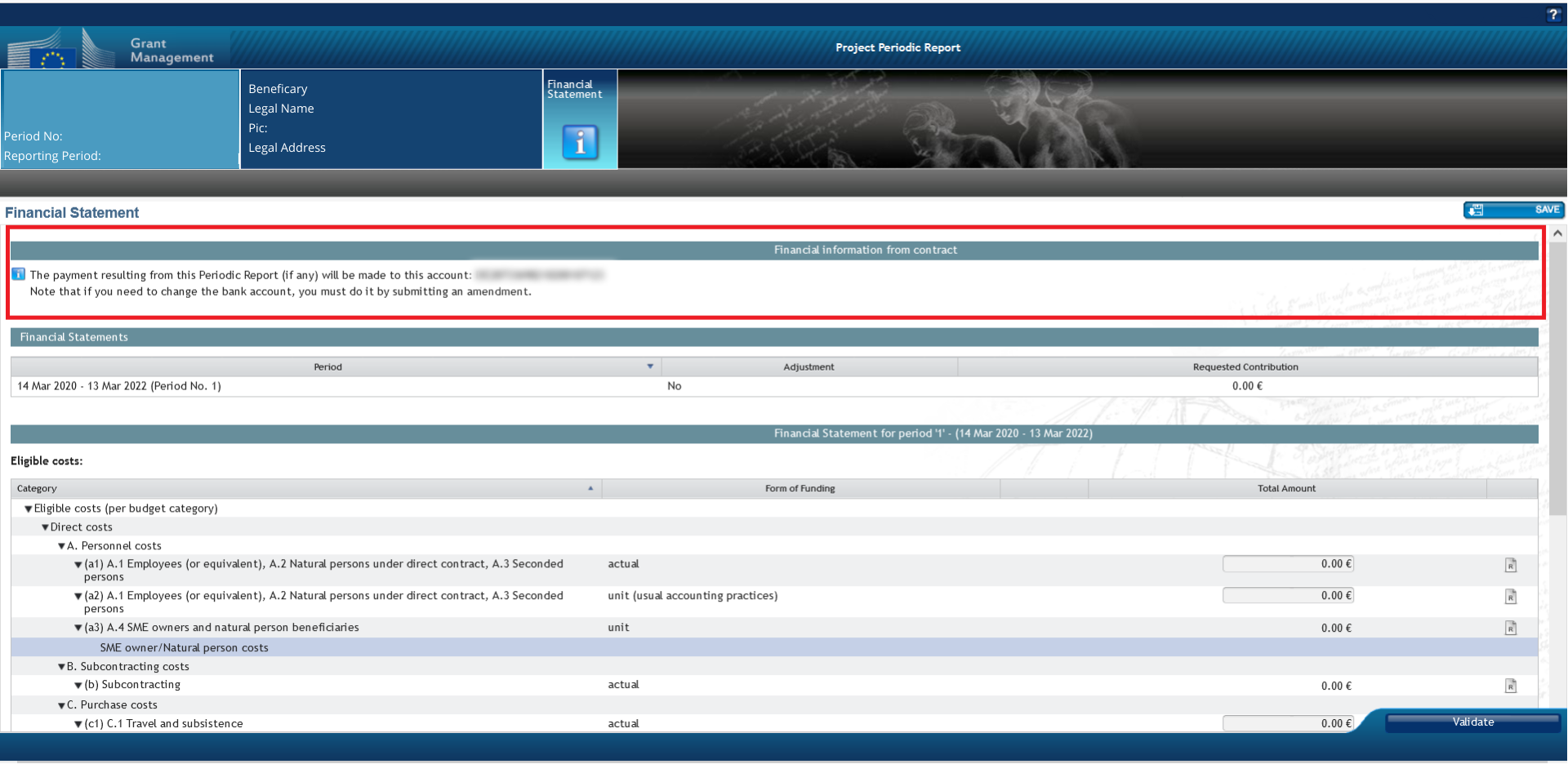

At the end of each periodic report, the financial statement will automatically appear, prompting each beneficiary to review and complete the following information:

- Review the financial information (bank account): This refers to the financial details provided by the beneficiary, and it is a read-only field in the financial statement. It displays information about the bank account where the payment will be made.

- Upload Certificate on the Financial Statement (CFS): The Certificate on the Financial Statement (CFS) is a mandatory requirement for each beneficiary in the interim or final periodic report if they reach the CFS threshold. The specific thresholds depend on the EU program and the type of action. The CFS is a factual report that needs to be prepared by an independent auditor or a public officer. Its purpose is to enable the European Commission or the grant awarding agency to verify and validate the eligibility of the declared costs. In the MFF 2021–2027, there is generally a single threshold of EUR 325,000 requested by the EU. Each beneficiary must submit a separate CFS as part of the reporting process.

- Stating eligible costs per category: Here you need to enter and explain the actually incurred costs per cost categories, but only eligible costs. We dive into this in details below in the second part of this article.

- Upload supported documents: If necessary, upload additional documents such as travel tickets, invoices, or any other relevant evidence to support the declared costs.

Locking for review

After completing the cost categories, adding the certificate (if required), and providing any supporting documents, you must lock the financial statement for review. The financial statement will be sent to the project financial signatory for review. The signatory can open it for review, request changes, or submit it to the coordinator.

Coordinator's review and submission

The coordinator reviews each beneficiary’s financial statement to ensure accuracy and compliance with the guidelines. Once validated, the coordinator needs to submit the financial statement to the European Commission.

The template for the financial statement for beneficiaries for a reporting period can be found in the Annex 4 of the Model Grant Agreement.

Stating eligible Horizon Europe costs per category

This crucial step involves populating the financial data with the total eligible costs per cost category for your beneficiary.

Certain cost categories have:

- an editable field where you can input the total cost for that specific category,

- some include a separate "Use of Resources" icon, which requires explanations for only a portion of the amount entered under a specific cost category.

Below, you'll find definitions and inclusions for the various cost categories, which will guide you in creating a comprehensive financial statement.

Direct costs

A. Personnel costs

A.1 Costs for employees (or equivalent) are eligible as personnel costs, if they meet the general eligibility conditions and are associated with personnel working for the beneficiary under an employment contract or assigned to the action. These costs should be limited to salaries, social security contributions, taxes, and other costs linked to compensation.

These costs can be calculated using the following methods:

Daily rate for the person x Number of day-equivalents worked on the action (rounded up or down to the nearest half-day).

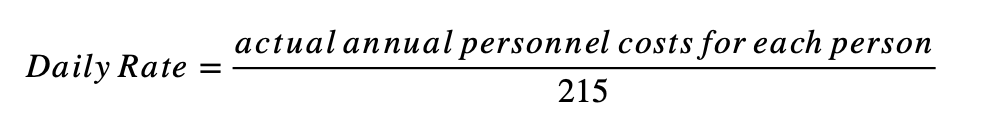

Daily rate is calculated:

A.2 Costs for natural persons working under a direct contract other than an employment contract are eligible as personnel costs.

A.3 Costs for seconded persons by a third party against payment are also eligible as personnel costs.

A.4 The work of SME owners for the action (i.e. owners of beneficiaries that are small and medium-sized enterprises19 not receiving a salary) or natural person beneficiaries (i.e. beneficiaries that are natural persons not receiving a salary) may be declared as personnel costs.

B. Subcontracting costs

Subcontracting costs are eligible if they are calculated based on actual costs incurred, meet the general eligibility conditions, and are awarded using the beneficiary's usual purchasing practices. These practices should ensure subcontracts with the best value for money (or the lowest price) and no conflict of interests. Subcontracting costs may include related duties, taxes, and charges, such as non-deductible or non-refundable value-added tax (VAT). If the subcontract is not included in Annex 1, an explanation should be provided and communicated with the project officer.

C. Purchase costs

Same as subcontracting costs, are acceptable if they are calculated on the basis of actual costs incurred, meet the general eligibility conditions, and are awarded using the beneficiary’s usual purchasing practices under the condition these ensure subcontracts with best value for money (or if appropriate the lowest price) and that there is no conflict of interests (including related duties, taxes and charges, such as nondeductible or non-refundable value added tax (VAT)).

The purchase costs include the following sub-categories:

C.1 Travel and subsistence – this sub-category includes the purchases for travel, accommodation and subsistence and must be calculated as follows.

Travel: On the basis of the costs actually incurred and in line with the beneficiary’s usual practices on travel.

Accommodation: On the basis of the costs actually incurred and in line with the beneficiary’s usual practices on travel.

Subsistence: On the basis of the costs actually incurred and in line with the beneficiary’s usual practices on travel.

C.2 Equipment – there are several options which you can add:

- Option 1 by default (depreciation only): Includes purchases of equipment, infrastructure or other assets and must be declared as depreciation costs, calculated on the basis of the costs actually incurred and written off in accordance with international accounting standards and the beneficiary’s usual accounting practices. Costs for renting or leasing equipment, infrastructure or other assets are also eligible, if they do not exceed the depreciation costs of similar equipment, infrastructure or assets and do not include any financing fees. Only the portion of the costs that corresponds to the rate of actual use for the action during the action duration can be taken into account.

- Option 2 full cost only: Purchases of equipment, infrastructure or other assets specifically for the action (or developed as part of the action tasks) may be declared as full capitalised costs if they fulfil the cost eligibility conditions applicable to their respective cost categories

- Option 3 depreciation + full cost for listed equipment at grant level: Includes purchases of equipment, infrastructure or other assets used for the action must be declared as depreciation costs, calculated on the basis of the costs actually incurred and written off in accordance with international accounting standards and the beneficiary’s usual accounting practices.

- Option 4 full cost + depreciation for listed equipment at grant level: Includes Purchases of equipment, infrastructure or other assets specifically for the action (or developed as part of the action tasks) may be declared as full capitalised costs if they fulfil the eligibility conditions applicable to their respective cost categories.

C.3 Other goods, works and services – purchases of other goods, works and services must be calculated on the basis of the costs actually incurred. Such goods, works and services include, for instance, consumables and supplies, promotion, dissemination, protection of results, translations, publications, certificates and financial guarantees, if required under the Agreement.

Use of Resources

You'll need to report the total amount of Purchase Costs claimed in the period. If these costs exceed 15% of your Personnel costs, you'll be required to provide a detailed explanation for the major cost items, down to the 15% threshold.

Tip: Unsure which costs to explain in detail until your threshold? The "Use of Resources" window in the Participant Portal will display a threshold amount, set at 15% of your total personnel costs for a specific period. This is the value of the costs you're allowed to leave unexplained.

For instance, if your personnel costs total to €50,000, your 15% threshold is €7,500 (€50,000 x 0.15). So, you need to detail all your purchase costs until the remaining add up to €7,500, starting with the highest-cost items. Any expenses that remain, those totalling to €7,500, don't need to be individually itemised, and leaving the smallest 15% of expenses unprocessed.

D. Other direct cost categories

Should be detailed in case its sum exceeds 15% of personal costs. The system will notify the user automatically, and it will calculate the minimum amount, which needs to be further explained.

- D.1 Financial support to third parties (if required for the call) – includes costs for providing financial support to the third parties in the form of grants, prizes, or similar forms of support under the conditions if they are declared eligible in the call conditions.

- D.2 Internally invoiced goods and services – costs for internally invoiced goods and services that are directly used for the action and may be declared as unit costs in accordance with normal cost accounting practice.

Indirect costs

Indirect costs are automatically calculated and will be reimbursed at the flat-rate of 25% of the eligible direct costs claimed (categories A-D, except volunteers costs, subcontracting costs, financial support to third parties and exempted specific cost categories, if any).

If you need to know more about the cost categories and the template for the financial statement for beneficiaries for a reporting period, you can find it in the Model Grant Agreement.

Collecting and calculating costs for your financial statement with EMDESK

EMDESK, with its templates specifically designed for Horizon Europe projects, can significantly assist you in preparing and gathering all necessary financial data for each beneficiary's financial statement. As a project and finance management software, EMDESK facilitates the collection of time and expenses throughout the reporting periods, allowing the coordinator to review spending and identify irregularities well before the official reporting to the EC takes place. This gives everyone ample time to react.

Manually collecting financial data from your project team and all partners towards the end of the reporting period can be risky, as it leaves no room for intervention or steering consumption in the right direction. This can lead to stress and potentially result in endless file exchanges, version consolidations, and feedback loops, which are prone to errors and inaccuracies. Overall, it's an inefficient process.

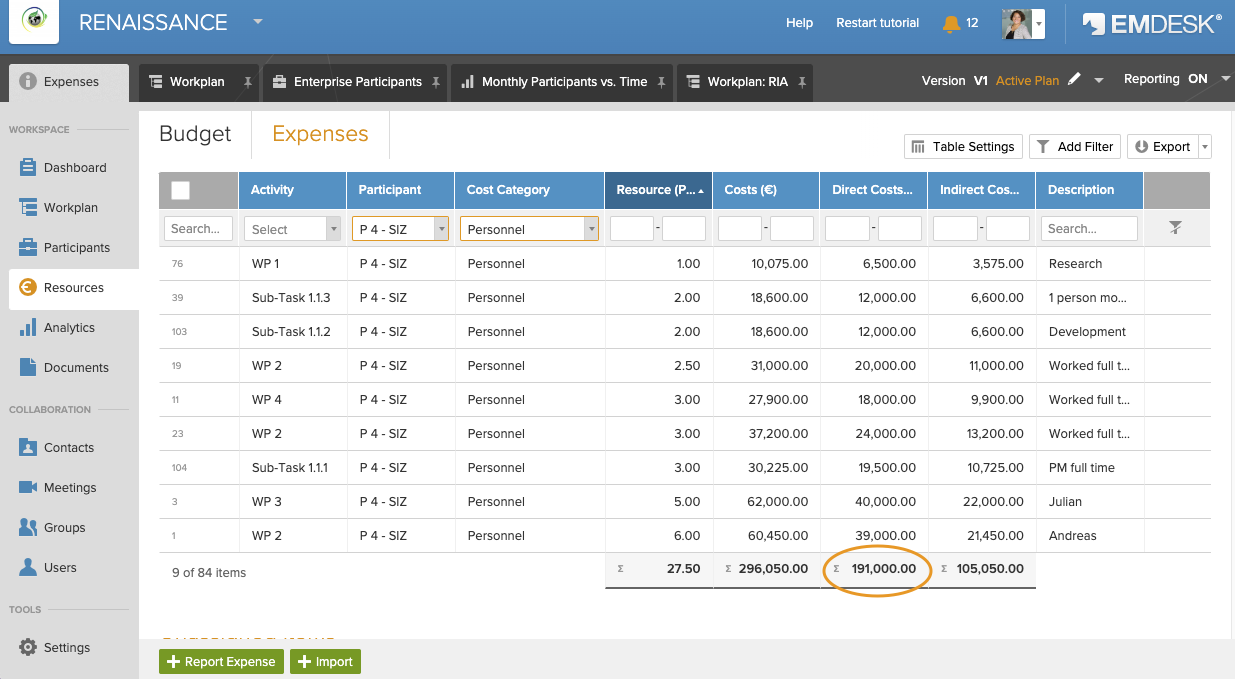

EMDESK offers accurate and real-time tools for monitoring project expenses, while collecting and consolidating reporting data from all project teams and partners in one place. Use advanced filters to narrow down the expense views to any desired reporting period and cost category to get the necessary data for your report.

For example, this financial overview in EMDESK shows the amount of personnel costs spent by Participant 4:

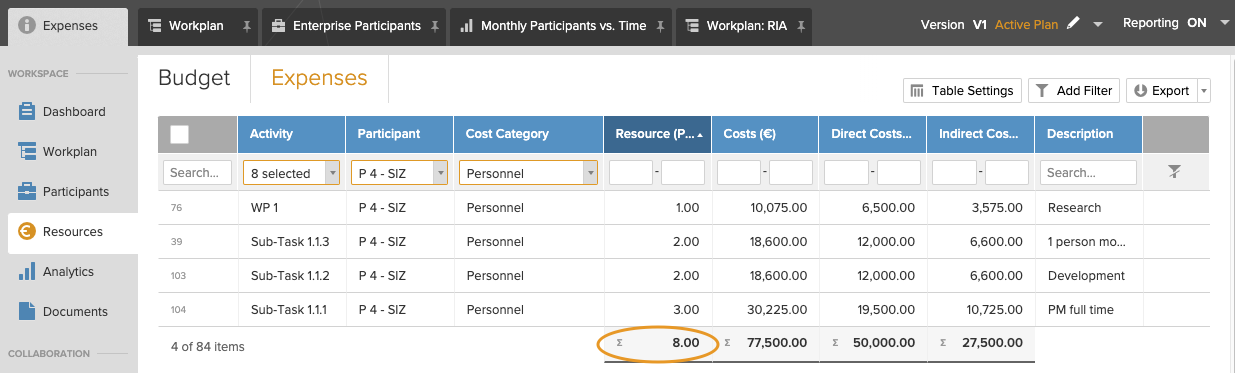

The "Resources" section of EMDESK is an ideal tool to track costs in any level of detail. For instance, for completing a financial statement you need to report the personnel effort per work package (WP). Just add one more filter to see the required data about each WP.

Creating a comprehensive and accurate financial statement is crucial for the successful management of Horizon Europe projects. This is a challenging process that requires a high level of accuracy and attention from all beneficiaries. However, with the help of a project and financial management platform like EMDESK, beneficiaries can confidently navigate the financial reporting process within the Participant Portal.

This article is written by Stefan Detschew, Chief Technology Officer at EMDESK.