In this article, we will start with the small modifications in Horizon Europe project cost management and afterwards outline the more complicated changes. The complexity arises when having to manage participation in both Horizon 2020 and Horizon Europe actions at the same time, because there are some costs that have to be calculated differently in Horizon Europe, in particular personnel costs.

Different words – same meaning

Some terminology changes with Horizon Europe, but the meaning stays the same. The following provides an overview.

Affiliated Entities are our former “linked third parties”. These are legal entities that have a link with the beneficiary, in particular a legal or capital link. This link cannot be limited to the Horizon Europe action nor be established for the sole purpose of the implementation of the action.

Associated Partners are derived from the “international partner” status in Horizon 2020. Associated Partners are legal entities that work on the Horizon Europe action as described in Annex 1 of the Grant Agreement but cannot declare costs. They do not sign the Grant Agreement, but the consortium partners must make sure that some of the articles apply to them anyway, amongst others regarding proper implementation of the action, conflict of interests, ethics, and even record keeping.

Purchase costs is a renaming of the budget category that was known as “other direct costs”, covering travel and subsistence costs, equipment as well as other goods, works and supplies, such as consumables, dissemination costs and publications, to name a few. The rules for the eligibility of equipment costs are the same as under Horizon 2020, since the general rule is that only depreciation costs are eligible for funding, and only the part that corresponds to the actual use of the equipment for the action.

Horizon 2020 article 11 on “in-kind contributions against payment” did not make it to the Horizon Europe Grant Agreement, but the costs can still be eligible for funding under the personnel cost provisions (as seconded personnel) or as other types of purchase costs.

Finally, the look of the Grant Agreement will be somewhat different. We will probably be very happy about the so-called data sheet, which sums up the specific data of the action, such as the starting date, grant amount and project periods, provided that they fulfil the general rules for eligibility.

New threshold for Certificate on the Financial Statement (CFS)

Just as with Horizon 2020, cost calculation in Horizon Europe, as well as cost documentation, need to be checked by an auditor of the beneficiaries' choice and sent in a so-called CFS.

However, the threshold changes, as well as the deadline for sending the CFS to the EU. In Horizon Europe, it is only when you request an EU contribution of 430.000 EUR as reimbursement of your actual costs, now including the indirect costs as well, and send in the CFS at the end of the reporting period, where you cross the threshold. This might occur during the last reporting period, as with Horizon 2020, or earlier. If your organisation is one of the few who will go through a so-called Systems and Process Audit (SPA), the threshold is higher. It is the European Commission who decides on the SPA, and your organisation will already have received a letter about it, if you fulfil the criteria.

Internally invoiced costs

If you have previously charged costs for goods or services which are produced or provided within your organisation as internal unit costs, then you probably have to recalculate the costs before charging them to your Horizon Europe action. Examples for internally invoiced costs include costs for self-produced chemicals, standardised in-house testing procedures or the use of the clean room, wind tunnel, etc.

The new rule is that you can now include actual indirect costs according to your usual cost accounting practice. This means also that you can no longer apply the 25% flat rate for indirect costs on top of your unit costs anymore. Depending on your usual calculations, these goods or services will have different eligible unit costs for Horizon 2020 and Horizon Europe, respectively.

Personnel costs calculation in Horizon Europe

Costs for employees (or equivalent), seconded personnel and the formerly so-called in-house consultants are calculated in a different way under Horizon Europe, and documented slightly differently, too. Cost calculation in Horizon Europe will not anymore be per last closed financial year. Instead, the calendar year will be implemented. Hourly rates will no longer operate. Now, daily rates will apply. If you have people working on both Horizon 2020 and Horizon Europe actions, this means that you have to calculate personnel costs differently, resulting in different eligible costs to be claimed to the EU.

The Grant Agreement uses a fixed number of 215 as eligible days of work per year. You cannot charge more days per person, but you can deduct the number of days the person has spent on parental leave or adjust to a pro-rata when on part-time.

The formula for calculating the daily rate is to divide the actual annual salary, incl. social security contributions, taxes and other mandatory costs linked to the remuneration, by 215. Then you multiply the daily rate by the number of days worked on the Horizon Europe action in that calendar year.

However, how long is a “day”? This question is particularly relevant when you continue with a time recording system in hours. The Annotated Model Grant Agreement will describe three options for calculating the day-equivalent: a) the EU gives you the possibility of using a fixed rate of 8 hours equaling a day, b) you look at the work contracts in your organisation. If it says you must work 37,5 hours over 5 days per week, for example, your day-equivalent is 7,5 hours. C) you base your conversion rate on the usual standard productive hours (the 90% threshold we know from Horizon 2020 continues to apply): if your standard annual productive hours are, for example 1.600 hours, your day-equivalent is 7,44 hours.

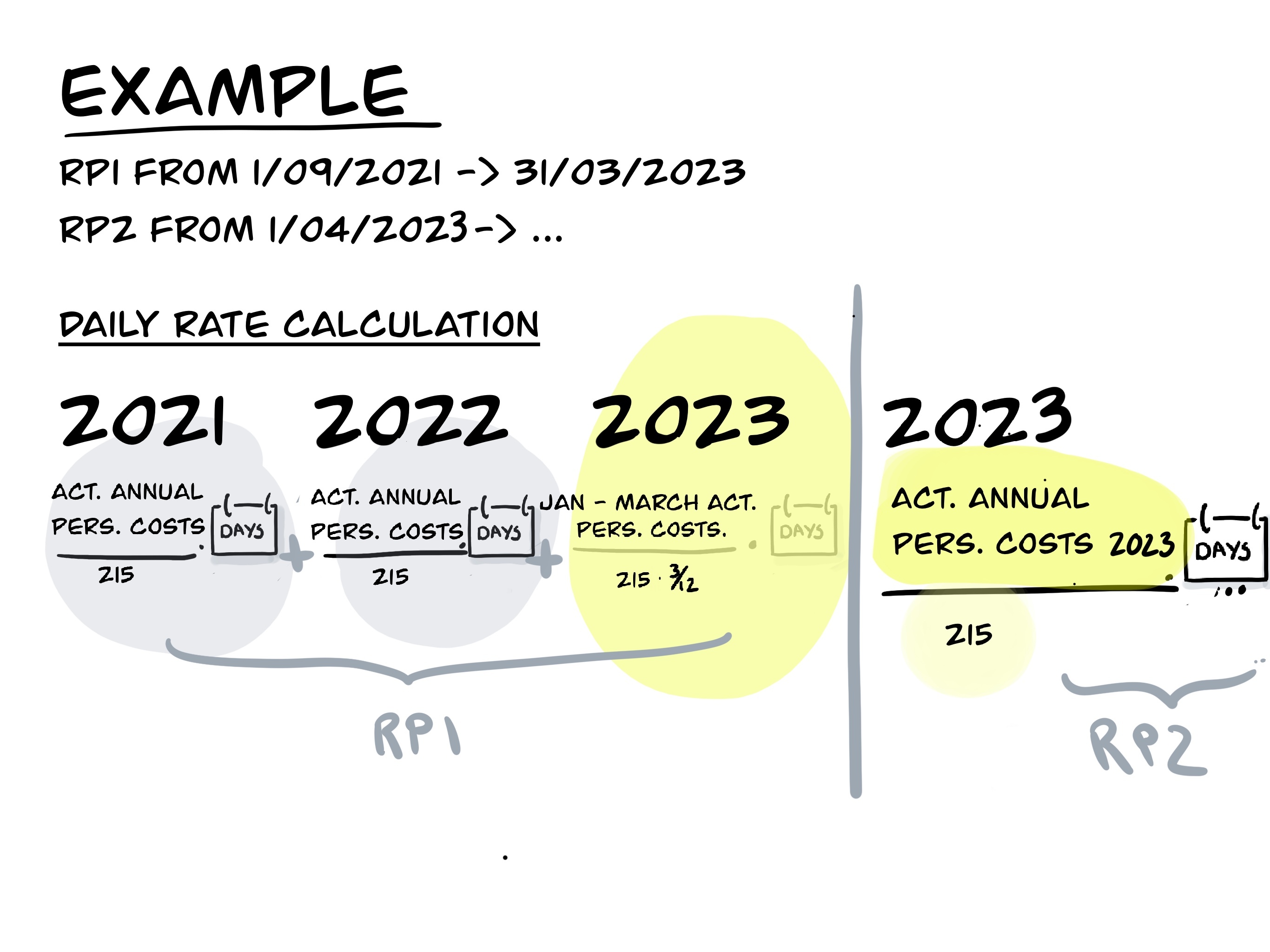

As mentioned, Horizon Europe now follows the calendar year with regards to personnel costs, and no longer the last closed financial year. Your project year might not necessarily follow the calendar year, however, and your reporting periods (RP) will most likely end somewhere during the calendar year as well. Daily rates and personnel costs follow each of the calendar years that are part of the project period. Below is an example as to how to calculate personnel costs in those cases.

Documentation of personnel costs

Time recording in hours is no longer required in Horizon Europe, but you may continue to use it if it is a reliable system. Just convert the hours to days following one of the three methods mentioned above. However, as a new rule, you can also document personnel costs by declarations signed monthly by both the person working on the Horizon Europe action and their supervisor.