In this article, we will talk about Horizon Europe personnel costs, going into thorough calculation details and tips, as well as common errors that the companies can avoid. This article is mainly about the personnel costs of projects that have already received the EU grant and they are in the implementation phase. However, if you are still in the application stage and you need some guidance and tips on Horizon Europe project cost management, you can also find some useful information here.

Which are the personnel costs and their importance in Horizon Europe

First of all, we need to understand when kind of expenses can be included in the personnel costs budget. For the Horizon Europe programme, the following four budget categories are eligible to be defined as personnel costs:

- Employees costs (including salaries/wages, bonuses, social security contributions – both for employer and employee, taxes, benefits and any other costs that may arise from national laws or the employment contract). This category refers to any cash compensation given to staff members, thus professionals hired by the company and there is a respective payslip or similar proof.

- Seconded persons/staff – this arrangements involves an employee being temporarily assigned to another part of company, a different employer within the same group or, in some cases, a different employer altogether (such as a client or business partner). For example, companies might second staff to their customers or clients on a secondment basis for a period of time (typically between three and twelve months) to work within the client’s organization.

- Natural person under direct contract – this category covers the costs for in-house consultants and similar persons that worked on the project. It is important to point out here that this budget category is not for companies (such costs can be declared as subcontracting ones) but self-employed (freelancers) natural person working part- or full-time for the respective project under a contract, not governed by the labour law.

- SME (Small and Medium-sized Enterprises) owners and natural person beneficiaries that are not receiving a salary under the Horizon 2020 Framework Programme. Please be careful here, as dividends, consultancy contracts, service contracts, etc. are not accepted for calculating the costs of SME owners!

As we have mentioned in other articles, personnel costs is the category with the highest budget share in the majority of EU funded projects (they can constitute even more than 50-60% of the overall budget, especially in these IT projects where the major development is about software elements – platforms, artificial intelligence, machine learning, data analytics, mobile applications – and thus, numerous expert professionals are required).

Main changes in Horizon Europe personnel costs calculation to Horizon 2020

In an effort to simplify and harmonise the overall approach of how companies calculate Horizon Europe personnel costs, the European Commission has conducted two major changes compared to H2020:

- The first one is that calculations will be implemented for the calendar year, thus the ‘’last closed financial year’’ rule does not apply any more.

- The second one is that hourly rates will no longer operate, replaced by a ‘’single corporate daily rate’’ approach. This means that if a company has people work on both H2020 and Horizon Europe projects, the personnel costs calculation needs to take place differently.

Personnel costs (PCs) calculation

As mentioned above, in the new Horizon Europe, personnel costs are calculated on the daily rate scenario. As such, the basic formula to calculate PCs in your project is the following:

Personnel costs = Daily Rate x Days worked in the project

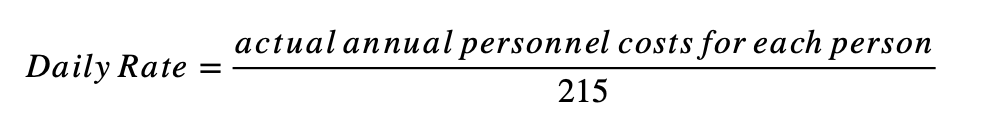

The daily rate needs to be calculated per calendar year (thus, from January to December, both included), following the below formula: Daily Rate = actual annual personnel costs for each person / 215

Note 1: 215 is the official number of working days per calendar year, according to the EU (equivalent to 1,720 hours – 215 x 8hrs/day).

Note 2: A company cannot declare a) budgeted time; b) estimated time (guessing of PC needs) and c) time allocation (e.g. X% of the time of the respective person).

To calculate the days a person worked you could either (i) use reliable time records (e.g. time-sheets) on paper or in a computer-based time recording system; or (ii) sign a monthly declaration on days spent for the action (the relevant template is still under development).

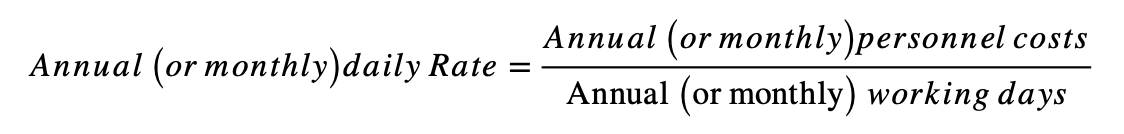

In case you need to report a full year (or month), the calculation is similar:

Be careful: the total amount of personnel costs declared (for reimbursement as actual costs) in EU grants for a person for a year CANNOT be higher than the total personnel costs recorded in the beneficiary’s accounts (for that person for that year).

It is also very common that companies increase the salaries of their employees just for the specific EU funded project. However, if this takes places only for EU grants, these additional costs are not eligible, unless the company is under the Project-based remuneration. You can find more details about this policy in the following official Horizon Europe Model Grant Agreement (MGA).

Avoiding errors in declaring Horizon Europe personnel costs

Companies are quite often committing errors when they declare Horizon Europe personnel costs (and not only), mainly due to misunderstanding or lack of attention to the rules and the details of the grant agreement provisions or sometimes unintentionally. Consequences can be quite important resulting from non-optimal use of funding resources to financial recoveries and severe corrective measures by the European Commission.

These exact errors we aim to avoid with the current article, analysing in detail the norms and approaches the new Horizon Europe programme uses when it comes to the personnel costs calculation. Nevertheless, we will share with you some additional insight that may be useful to avoid such errors:

A general control objective must be to bring the residual error rate (which is the ratio of the number of incorrectly declared costs that are not detected as such, over the total number of declared costs) as close as possible to an acceptable level, thus to 2%. Auditing services for the assessing Legality Regularity of Horizon Europe project payments will always help.

As the main detected errors are due to incorrect time working on the project, incorrect remuneration costs and unreliable/missing timesheets, you need to make sure that your time recording is:

- Consistent with HR records;

- Properly dated and signed;

- Not in excess of your full time employment;

- Sufficient in terms of information.

Double check your formulas. Be careful not to include ineligible items and costs included in other budget categories (e.g. indirect costs) in your numerator and that the correct amount of working days is in the denominator.

Finally, make sure that (i) your time charged to the project is correct; (ii) time records meet the Grant Agreement’s (GA) conditions; (iii) personnel cost formula and transaction listing reconcile; (iv) employment Contracts are in place; and (v) you used the exchange rate stipulated by the Horizon Europe GA.

This article is written by Panos Antonopoulos, Innovation Consultant.

Effortlessly manage daily rates and personnel costs in Horizon Europe projects with EMDESK

EMDESK's powerful features allow for seamless management of daily rates and personnel costs in Horizon Europe projects. With intuitive tools, users can establish daily rates for every participant or employee and accurately report the person-days dedicated to each work package.

- Profile Creation: Easily integrate each employee into the system by listing them as sub-participants under your organisation in the 'Participant' section.

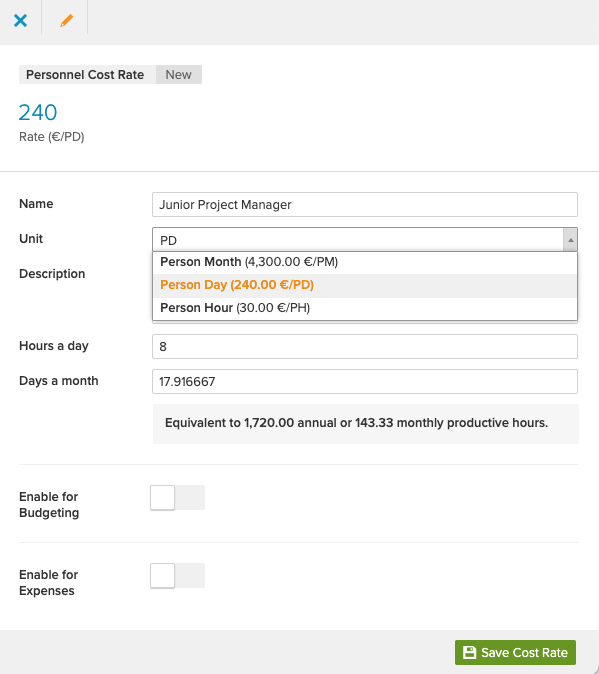

- Accurate Daily Rate Configuration: Determine the daily rate by considering the total annual costs for each individual and dividing by 215. EMDESK's "Financial Profile" tab streamlines this process, letting you input the calculated rate, and adjust the work hours to achieve the standard 1,720 annual productive hours or 215 days.

*EMDESK’s Horizon Europe project templates have 8 ‘Hours a day’ and 17.916667 ‘Days a month’ pre-filled by default in order to have the annual productive hours equal to 1,720 for a more accurate financial report.*

- Effort Tracking and Reporting: Employees can record their work effort for different work packages. EMDESK automatically computes personnel costs based on the preset daily rates.

- Comprehensive Reporting Tools: EMDESK provides robust monitoring tools, including a specialised report showcasing each employee's work dedication to each package throughout the year. This assists in the effortless completion of the yearly timesheet declaration for the EC.

Experience the blend of precision and convenience with EMDESK's advanced features, designed to cater to Horizon Europe projects' intricate demands.