The financial administration of EU-funded projects, as the whole process of Horizon 2020 project management, comes with many challenges. When the deadline to the first cost reporting gets close, some project managers invest considerable time locating invoices, contracts and notes, calculating costs and filling in the compulsory reports. If they don’t have a clear overview of the paperwork required, they hope the EU auditor does not knock on their door to check the accuracy of their records.

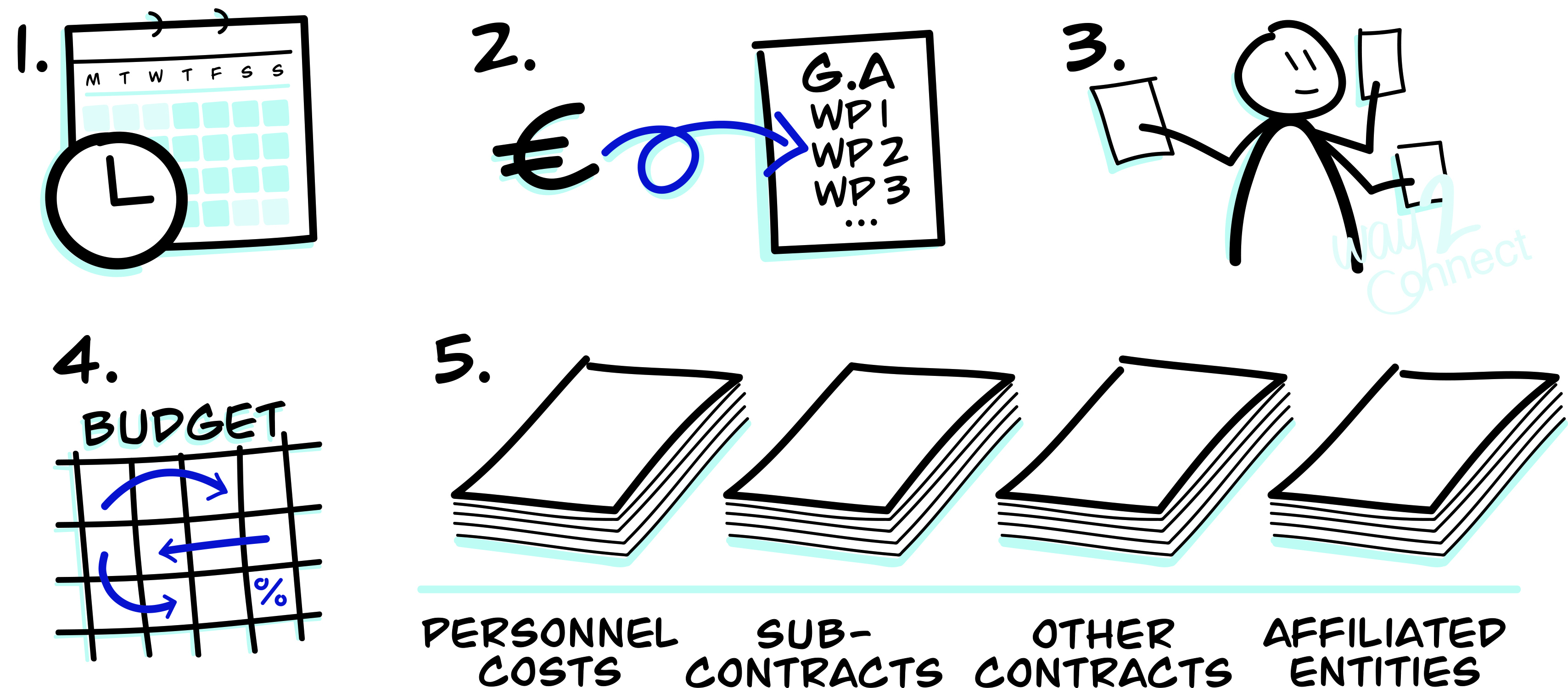

These five foundational practices will help you get everything right from the start and save time.

1. Record all your expenses, even your time

The EU reimburses part of your costs and may ask you for documentation to ensure your reporting and claims are accurate. “Lack of supporting documents” is one of the main errors that EU auditors find when they go through the books of EU project participants. Article 6 of your Grant Agreement does state, however, that costs need to be “actually incurred, identifiable and verifiable” in order to be eligible for EU funding. When project participants cannot show evidence for the costs they have claimed to the EU, they must pay this part back, even though the costs have actually incurred.

Documentation of time spent on project tasks is a very common weakness in many participating organizations. Missing or unreliable time records is one of the most frequent errors, auditors find. Imagine you have spent 2 years working on the project – and find out during an audit, that the auditor deems your time recording system to be unreliable. It is very unlikely that the EU auditor will accept all these costs even though the project work has been done successfully.

Article 18 of the Annotated Grant Agreement describes the minimum requirements for time recordings. Amongst others, they must be signed by both the person working for the EU project and the supervisor. Also, auditors will check whether the time recordings match records of annual leave, sick leave or other forms of absence. Therefore, it is advisable that you double-check your records every month. Auditors may also ask for any written procedures to ensure that the number of hours cannot be changed after the signatures. A simple data sheet is thus not necessarily enough as a time recording system.

Another important feature for reliable time recording is that it includes a reference to the action tasks or work packages, the person has worked on. This brings us to the next foundational practice.

2. Purposefully link your expenses to the project activities

The EU only reimburses the costs of project-related activities. As it is stated in article 6 of the Grant Agreement, the costs “must be incurred in connection with the action as described in Annex 1 and be necessary for its implementation” in order to be eligible for EU funding. During project reporting, you will be asked how you distributed your time and expenses between the work packages of your project.

Periodic project reporting consists of a Financial Statement and a Technical Report. The Financial Statement only requires a few aggregated figures from you. In addition to that, however, you need to specify the “use of resources”, where you write down the number of person months per work package or briefly describe major cost items and their connection to the work packages. By noting this down clearly from the moment you register the expenses in your accounts, you have the information at hand when you need it. Also, there must be coherence between the Technical Part and the Financial Part. Therefore, make sure you can easily extract the link between costs and project activities from your accounts when you need them.

3. Always counter quote

You must be able to document that you have followed good housekeeping principles when spending EU taxpayers’ money. Make it a habit to search the market before you purchase any goods or services – and to keep documentation for all that you did.

Article 6 of the Grant Agreement asks you to comply with the principle of sound financial management, in particular, regarding economy and efficiency. This does not necessarily mean that you ought to go for the lowest price when purchasing goods or services for the project. You can also decide on the best value for money relating to the qualitative criteria relevant to your EU project work. Either way, you must be able to provide documentation for your choice, because the EU auditor will want to make sure that you did not have any so-called “excessive expenditures”. In practice, most legal entities have internal policies in place as well as public procurement rules to follow. Also, common sense indicates that there will be some minimum threshold for counter quoting, even though the Grant Agreement does not provide a clear specification. My recommendation, particularly for private legal entities would be to use caution and to seek alternative quotations.

4. Find your freedom in your budget

It is likely your real expenses will deviate from what has been budgeted. The Grant Agreement allows for some flexibility. Just explain the reason for the deviations during project reporting. However, if the deviations are caused by significant changes in the project implementation, you will have to involve your EU Project Officer and get their approval.

Compared to many national funding schemes, Horizon 2020 project implementation is surprisingly flexible. Article 4 of the Grant Agreement allows for budget transfers between project partners, cost categories or forms of costs without involving the Project Officer. It is important, though, that you describe the reason behind these changes in both Financial and Technical Reporting in a clear and transparent manner. Otherwise, your Project Officer or your Financial Officer might ask for additional explanations, which will make the approval process more tedious and time consuming. It is better to get it right from the start.

If the budget changes are caused by significant changes in the planned project work, however, you will have to ask for an official amendment. This means that the wording of Annex 1 (your former proposal) and the figures in Annex 2 (your budget) are changed and approved by the EC. For example, if the reason behind your budget changes is that you dropped one of the tasks that were originally described, we are talking about a “significant change”. This will most likely lead to more paperwork, but it is important to do that. You want to make sure that all your project-related costs are eligible for funding, especially if some of the project work has had to be re-focused. Talk to your Project Officer, if in doubt, about what is needed.

During project reporting, always study the work package description in the implementation section of your proposal/ Annex 1 in order to make sure that there is coherence between both Grant Agreement and Periodic Reporting and that you are transparent about any deviations.